For the past several years, cars are transforming in several ways and are not limited to only transportation now. It has now turned into a state-of-the-art massive-scale computer on wheels. Digital transformation’s impact on the automobile industry is spearheading this growth and evolution and the connected car is commencing to take a considerable lead in the market, also providing new-fangled possibilities for various ecosystem associates, consumers, and automakers. It is now on the way to become a common norm in the automobile industry and is already turning into a reality in the last few years with the advancement of technologies such as 5G, IoT, AI, Telematics, electric vehicles, and the cloud. It is important to say, connected cars are gaining more popularity because it plays a pivotal role in the software-coupled vehicles that make transportation more effective and smart.

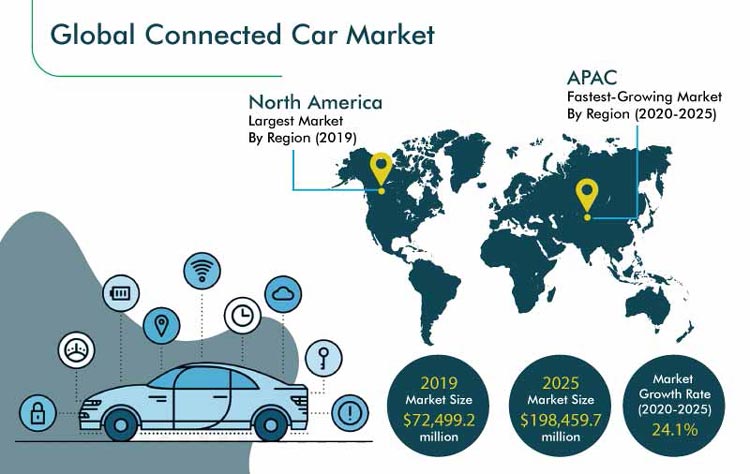

According to some global automobile experts, by 2027, the growth of connected cars in the market is speculated to be $125 billion. Now, as the demand for greater or larger connectivity is growing, connected cars furnished with 5G are going to take the lead in the automobile industry. Apart from having several benefits, connected cars are mostly safer for the environment, and at the same time, it offers an opportunity for the car industry to craft new technologies and develop deep relationships with customers. 5G connectivity is now speculated to be the future of mobility and reinvigorate the automobile sector. The United Nation in its report on 2020 highlighted that about 1.3 million people die every year because of road traffic mishaps and around 20-50 million suffer non-fatal injuries, most of them are at-risk road users, cyclists, and pedestrians. The unleash of connected vehicles offers a seamless flow of information between road infrastructure, vehicles, and pedestrians, which implies chauffeurs will be alerted to any kind of nearby dangers like broken vehicles, decreasing the volume of traffic accidents.

Where is the Growth of Connected Cars Heading?

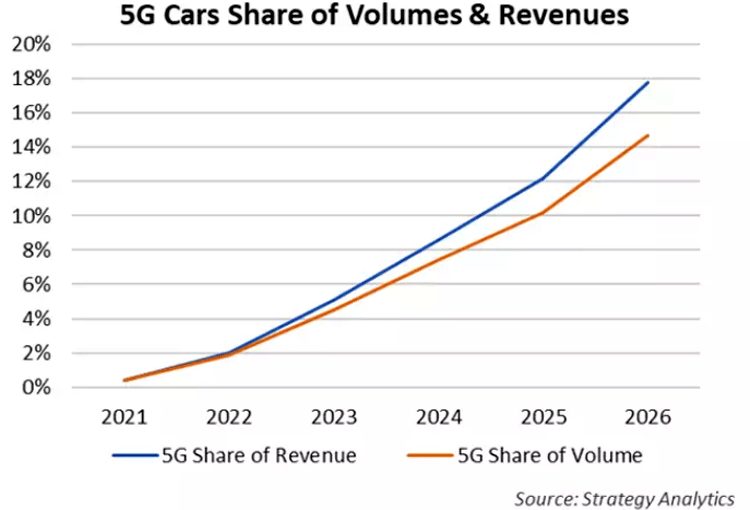

According to the latest report by International research firm Statista, the growth of connected cars in the market is expected to escalate to over 70% in 2025 up from 40% in 2020 and the report also added that the international market for the connected cars is anticipated to boost from $56 billion in 2020 to about $65 billion in 2021. In this context, India is taking a good stand in enhancing and boosting the next big frontier for connected vehicles, and the nation’s market in this regard is speculated to grow over 20 percent in the coming few years with the availability of connected services ranging from 25 percent to 75 percent across various categories of OEMs. Hence, the demand and public acceptance of connected cars are going to grow significantly in India over the coming years. Another research firm Markets and Markets stated that the market for international connected vehicles is speculated to reach USD 56.3 billion by 2026 from a speculated USD 23.6 billion in 2021, at a CAGR of 19.0 percent from 2021 to 2026. There are actually several factors spearheading the market for connected cars such as the augmenting adoption of integrated connectivity, unveiling of rigorous safety regulations, and adoption of high-end luxurious vehicles.

Now, slightly speaking about the impact of the coronavirus pandemic there is already a decrease in production in the automobile industry from 2018, but the onset of the pandemic has thrown a huge blow on the entire automotive industry, which has disturbed or rather disrupted the supply of imperative automobile components. The key players in the sectors like BMW, PSA Group, Volkswagen, General Motors, and Fiat have slowly halted their manufacturing, which has also affected the market for connected cars as the growth of this segment is related to the manufacturing and production of cars. The government’s escalated effort for building cutting-edge transportation systems, escalating demand for smartphone features in the car, and automated driving technologies coupled with passenger safety features would further uplift the growth of this market. Then, a majority of Tier 1 firms and OEMs have witnessed several supply chain disruptions, which ultimately disturbed the supply of components and raw materials causing delays in production. Several countries such as Japan, China, and India hold a huge share in the worldwide production of passenger vehicles, and witnessed a decline of 14 percent, 15 percent, and 17 percent respectively in 2020.

How Supply Chain Challenges Crippled Global Car Market, Including Connected Vehicles?

A latest survey report from Counterpoint Research’s Smart Automotive Service stated that amid the current slump in production semiconductors, cargo disbalance, cost boom, and production losses, the connected car market remained buoyant throughout the world in 2021. The report also highlighted that 4G powered vehicles are gaining more traction in developed countries such as UK, US, Germany, and China alongwith the entry of 5G Telematics Control Unit (TCUs) that helps in the utilization of seamless data transfer, speedy cloud-car communications, and various other enhancements. The shortage of semiconductors and other challenges associated with this industry proved to be inimical to the entire automotive ecosystem, whereas renowned OEMs like Ford and GM suffered a huge loss with lakhs of cars waiting in the factory for chips to appear.

Many of these car manufacturers are utilizing the “Build-Shy Strategy” where cars are being manufactured with limited components and then they are kept aside until other required resources are obtainable for complete manufacturing. Experts feel that at this crucial time this strategy could be useful as it helps the production running, but there is no assurance that how long the cars could be unsaleable. The shortage of chips forced car makers to shift to other ways to reduce losses and avoid disbalance in production like escalating vehicle costs, wiping out certain features, and moving inventory/chips to some more profitable models. For instance, Renault and BMW were selling a few cars without digital screens, while Ford and Nissan were doing the same without navigation systems.

Source: P&S Intelligence

Fahad Siddiqui, Research Associate at Counterpoint Technology Market Research said, "At a very increasing speed, digitization is shifting towards vehicles completely and can be viewed properly as the penetration of worldwide connected cars is soaring high constantly. If all the countries in the world fortify their 4G network coverage and call for top-notch cellular technology, then we can witness the appearance of more connected cars in the market furnished with cutting-edge comfort and safety features.”

Now, coming to some more statistics, Fahad added that back in 2021, the connected car market in the US boosted to 16 percent year on year with GM shipping more connected cars as compared to 2020. As the overall sales of GM is quite low, the market research firm observed a plunge in the company’s connectivity penetration. For the time being, the company also stopped its ‘Super Cruise’ feature that allows hands-free driving on long roads in its flagship model Escalade SUV. There are several other features that have been stopped temporarily including HD radio, fuel management software, heated seats, auto start-stop, and wireless charging in models like GMC’s Sierra and Chevrolet’s Silverado. In spite of the massive semiconductor challenges and supply chain disruptions, General Motors managed to grab 3.7 percent and 47 percent YoY growth in revenues and profits towards the end of 2021.

Due to a very low inventory, Toyota managed to defeat GM and grab first spot in the US automobile market for the first time. Interestingly, in the same year in 2020, China successfully defeated the US in the connected car shipments and it also proclaimed to rule the segment through 2025. There are various other countries that observed growth in this segment that includes France, Germany, and the Uk. Automobile experts clearly noted that the massive registrations of electric vehicles in Europe also helped in spearheading the penetration of connected cars in the region. Tesla was claimed to be the leading producer of EVs in Europe, which is then followed by VW and Renault. It is highly speculated that as global transportation is moving towards electric, OEMs like Fiat and Hyundai would make the market for EV more sturdy by unleashing innovative models.

The German car-maker BMW unleashed the world’s first 5G connected car in November 2021, known as iX, which is considered to be a benchmark in the global automobile industry. Highlighting the connectivity issue, Neil Shah, senior automotive research expert said, “China is already leading the 5G connected car market, which is due to endless assistance from government, and superior network infrastructure and would witness the entry of latest cars in this category in 2022 from various brands such as Geely, Ford, Chevrolet, BMW, and Buick. Moreover, the previously launched 5G cars in 2020 such as Arcfox Alpha T, Roewe Marvel R, and Great Walls 3rd Gen Haval H6 are likely to gain more popularity in the market. From the first half of 2023, other major firms like BAIC and SAIC will enter the market.”