In the quarter one of 2023, sales of battery powered electric cars increased by 32 percent YoY, but there is a sales decline of plug-in hybrid EVs by 13 percent YoY

A latest survey report has now mentioned that the growth in sales of electric vehicles in the European region has escalated by 13 percent YoY in Q1 of 2023. Now, when the entire sales of cars are taken into consideration, there are massive signs of growth and improvement in the region, although they are yet to meet the target like the pre-pandemic levels, claim experts. If the total EV sales are taken into account, Germany is spearheading the segment, which is then followed by the UK, France, Italy, Netherlands, and Norway. Speaking of sales of the passenger cars segment in EVs, the highest growth was observed in the Netherlands and Norway.

The point to be noted is that in the quarter one of 2023, sales of battery powered electric cars increased by 32 percent YoY, but there is a sales decline of plug-in hybrid EVs by 13 percent YoY. It was also observed that the EV market share of passenger vehicle sales reduced drastically in Q1 2023 as compared to that of Q1 2022. A counterpoint survey report has further highlighted that there has been a huge improvement and development in the EU region for hybrid EVs and mild-hybrid EVs. This provides a crystal clear picture that Europe has been busy in unleashing a lot of schemes and initiatives to capture the lower-end electric car market, while at the same time, it is developing the battery infrastructure and craving for a circular economy. These initiatives are already given high priority much before putting a solid emphasis on genuine EV sales.

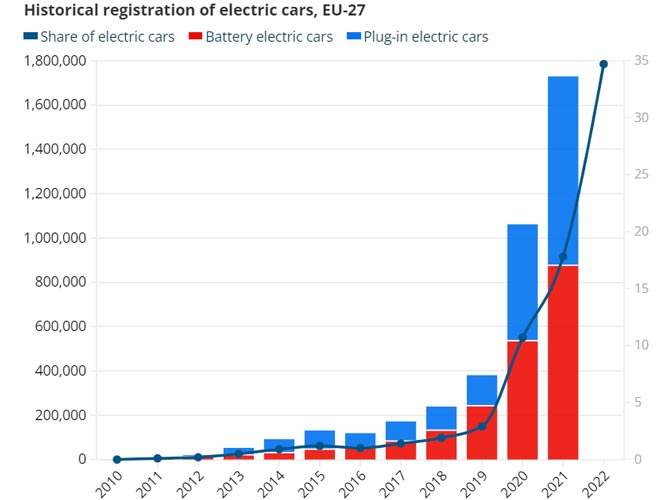

Sohinder Gill, CEO at Hero Electric India said, “Currently, it is right to say that vehicles powered by batteries are leading the automotive market. Amid the coronavirus pandemic and the ongoing supply chain imbalances, the growth in EVs are still significant. The current impediments and augmenting production prices due to escalating raw material prices, electric cars sales are still moving at a rapid scale. Now, if the pace continues at the same level, then very soon this segment will wipe out the sales growth of conventional ICE vehicles. If you see the market in 2020, EV sales have increased by two folds in 2021 with an increasing rate of 108 percent. Ultimately, it has helped EVs sales to have 5 percent of international passenger car sales in 2021.”

In 2021, when strict lockdowns were imposed throughout the world, China still topped the list in highest number of EV sales, which is around five times more than Germany. There are a couple of imperative factors that have helped China to lead the EV sales that includes massive subsidies on EVs, a huge variety of mini electric cars, and more cost-effective varieties are appearing in the market. What’s interesting about China is that around 3.3 million electric cars were sold in China in 2021 and during the same year, the fleet of EVs in the country stood at 7.8 million. The stock of electric cars are actually double the volume in 2019 and during the same period around 2.7 million BEVs were sold, which accounts to 82 percent of the new electric car sales.

Europe’s EV market share reached 66 percent between 2020 and 2021, and the sales share of plug-in hybrid EVs witnessed the largest in the globe. The European EV market is driven by purchase incentives and schemes, a huge variety of models, and market evolution. The growth is expected to increase more in the coming years due to Eu nation’s strict adoption of Co2 emission standards and also magnetizing zero emission vehicle standards. Although the EV market is growing massively in the EU, it is still limited to a part of the region. Speaking of the overall EV sales competition, the US, China, and Europe account for 95 percent of the market, while the other parts of the world including India are still facing challenges to come close to it. The major challenges other countries witnessed are mostly lower subsidies by the government on manufacturing and purchase of EVs, lack of proper charging stations, and extremely high prices of the vehicles.

According to an exclusive report of the International Energy Agency, in 2021 EV sales augmented by more than 65 percent YoY, which is around 2.3 million. The sales remained solid in the region in spite of the fact that the global automobile market is yet to recuperate from the pandemic. The period of five years between 2016 until 2021, sales of the electric cars in the Eu region increased by a CAGR of 61 percent, which is larger than China 58 percent and the US 32 percent. The global automobile experts opine that the distribution is bumpy throughout the EU nations. Germany still holds the record of highest number of EVs sold in the region, which is around 25 percent. The highest market share for new electric car sales in 2021 in Europe are Norway (86%), Iceland (72%), Sweden (43%) and the Netherlands (30%), followed by France (19%), Italy (9%) and Spain (8%).

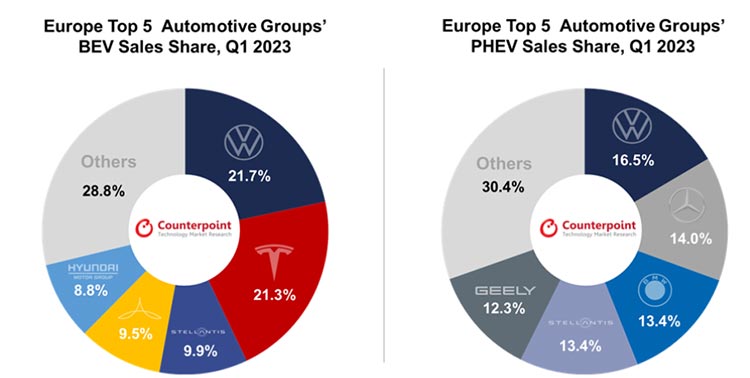

Now, speaking again of the EV sales in Q1 2023, the market is dominated by top five automobile firms such as Volkswagen, Tesla, Stellantis, Mercedes Benz, and Hyundai-Kia. All these companies accounted for nearly two-thirds of the market share. While speaking of genuine electric cars, Tesla grabs the second spot and is a bit behind Volkswagen. In terms of PHEV market, Volkswagen again tops the chart and is followed by Mercedes Benz and BMW. At this moment, the EV makers in China are facing a lot of challenges to perk-up their market in the EU region in this quarter. Nonetheless the chinese companies such as Aiways, NIO, BYD, Ora, and MG slightly managed to augment their share as compared to the preceding year. But, companies such as Xpeng, LYNK & Co, and Hongqi faced hurdles in the EU market. Experts anticipate that the Chinese EV manufacturers will be able to increase their sales share in the EU nations in the coming quarters by providing affordable vehicles with cutting-edge features and this because the EV market is speculated to perform better.

Highlighting the growth of EVs in the European market, senior automobile research analyst at Counterpoint Research Peter Richardson said, “In the current quarter, the overall penetration of electric cars in passenger vehicles sales slumped by 18.4 percent from the previous 27.6 percent in Q4 2022. This shift is considered to be notable compared to the earlier trend of continuous Quarter on Quarter growth. Now, other than France, all the major nations in the EU witnessed the growth slump.”

Richardson further added, “There are a couple of reasons that have boosted this revenue slump. The financial conditions were very unsteady and because of Norway’s removal of the EV subsidy scheme. In Europe, Germany has the biggest market share of EVs, which also witnessed a revenue decrease because of the ongoing recession and lesser consumer spending. But from April 2023, the market in the EU has started observing signs of growth and therefore, it is speculated that EV’s share will increase more than 25 percent towards the end of this year.”

The point to be noted is that throughout the four countries, the price factor is very important. This is because battery powered cars are so expensive which is why it failed to gain the desired traction among the European consumers. Around 60 percent of the citizens are still hesitant to opt for EVs and the number has massively escalated in Germany from 40 to 61 percent, and the Netherlands from 54 to 66 percent. Secondly, the possibility of not finding ample charging stations and the worry regarding the presence of low charging ports has also increased by 5 percent. Also, four out of 10 Europeans still think EVs take more time than conventional gasoline vehicles.

Rohit Pandit, managing director at Shuzlan Energy told CircuitDigest, “Currently, everything in the European countries now depends on the commitment made in the Paris agreement. Currently, in Europe, the market for EVs are now mandatory and compulsory. They are constantly making numerous efforts to meet the goal unlike India and this is why Eu is moving forward. The infrastructures are being built stupendously and the subsidies and incentives are also very high. In India, there are a lot of bottlenecks as we have started the initiative very late and we face immense challenges while working on the ground.”

In the past few years, various countries in Europe have been provided with fiscal incentives like taxation exemptions for the consumers who choose to purchase an electric car. The government of France also offers incentives of up to €5,000 to help people purchase electric vehicles, which are powered by hydrogen, electricity or the amalgamation of both. In the EU, the transport sector is the largest contributor of carbon emissions and hence, the commission in Europe barred selling of ICE vehicles by 2035.