Over the past few years, electric vehicles have now appeared as a pivotal point of realizing environmental policies all through the globe. In order to meet the same, the automobile manufacturers have realized that their future products will be crafted outside the ecosystem of conventional internal commercial engines (ICE). Hence, their business models and strategies are being tweaked to go ahead with the time. For electric cars, the most crucial and expensive component is the battery and the competition rat-race is escalating among OEMs and battery makers all over the world to strengthen its foothold in the EV battery market. The positive aspect is that this rat-race is opening the gate for emerging and cutting-edge technologies.

Now, in the automobile industry, lithium-ion batteries have gained more traction than the other ones, which is simply because of the fact that in a very small package, these batteries have the potential to collate huge amounts of energy. In the past few years, more innovative battery technologies are being developed and researched to replace the lithium ones in terms of sustainability, efficiency and cost. Experts state that most of the new battery technologies are not transforming the diaphragm when it comes to energy storage and powering devices. The biggest reasons why researchers are carrying out research on new technologies are mostly associated with safety like fire danger, and the sustainability of the materials utilized in the manufacturing of lithium-ion batteries, like magnesium, cobalt, and nickel.

Researchers have also added that there has been a massive improvement in the making of lithium-ion batteries and other battery technologies. Therefore, let’s find out below some of the upcoming battery technologies waiting to appear in the global EV market.

NCM 811

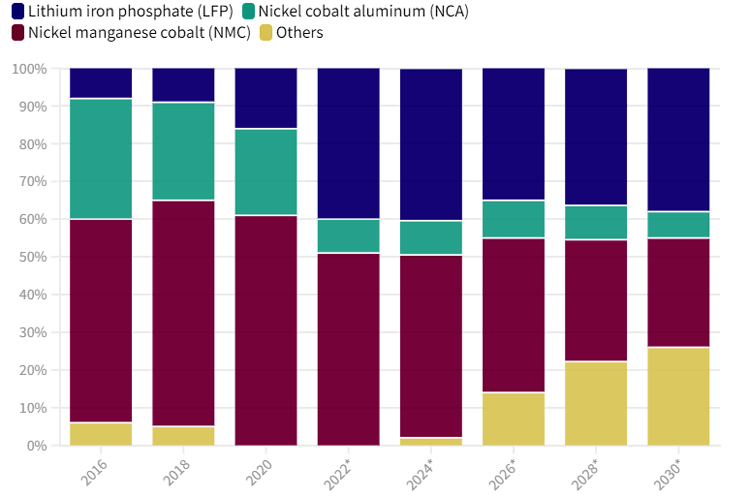

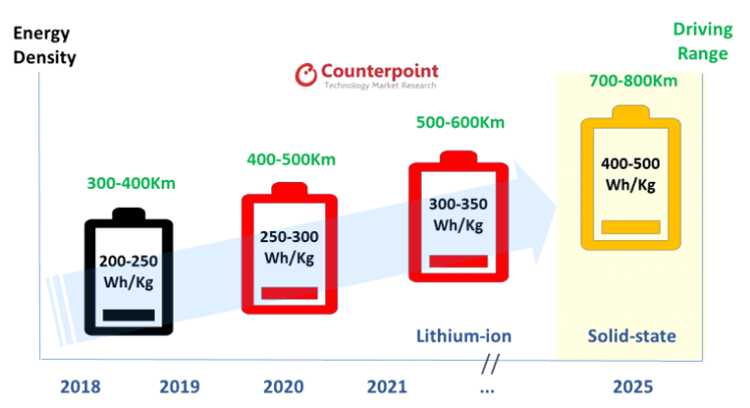

The energy density of lithium-ion batteries needs to be enhanced and therefore, battery-makers are investing largely on R&D and although the momentum of the improvements has been a bit slower, but lithium-ion batteries have helped in augmenting the speed and range of EVs with the help of high-energy source materials and also developing the per-unit cell size. On the other hand, various efforts have been undertaken to increase the nickel portion of total cathode materials. Earlier, many of the large battery makers have proclaimed to launch NCM 811 by 2019-2020, claims Counterpoint Research. Most importantly, NCM 811, which is equipped with 80 percent nickel, 10 percent cobalt and 10 percent manganese has a larger longevity and offers EVs with longer range on a single charge, claims Counterpoint Research. Battery manufacturer AESC announced that they are manufacturing NCM811, which promises more than 300Wh/Kg and 600-650Wh/L in 2020.

Solid-State Batteries

These batteries utilize a solid electrolyte other than a gel or liquid electrolyte. The solid electrolytes are mostly a solid polymer, ceramic, glass crafted with sulphites. This year, global auto firm BMW announced that it will commence testing solid-state batteries for its utilization in the EVs, which will be manufactured by Solid Power. PCMag claims that these batteries are now already being utilized in some smartwatches and pacemakers. These batteries, when compared to lithium-ion, pack more power and are also more efficient. Therefore, the batteries used in EVs could be charged faster, compact in size, weigh less,and escalate driving range. Some media reports highlighted that solid-state batteries have more longevity with seven times more charging capacity. Most importantly, they are safe to operate because the solid electrolytes are fireproof. CNBC reported that these batteries could be used in EVs in early 2024.

Lithium-sulfur Batteries

In this technology, the battery’s cathode utilizes sulfur, which is more sustainable than cobalt and nickel mostly found in the anode with lithium metal. The US based battery-maker Conamix is researching to make this technology a reality and is looking forward to launching this in the market in the coming five years. Now, apart from energy storage, these batteries can also be used in trains and aircrafts. According to the experts, sulfur is available in higher quantities and is less expensive and therefore, it can reduce overall cost. There are no additional production facilities required for this battery because the manufacturing process is the same as that of lithium-ion batteries. But, the problems are corrosion and these batteries don’t last long like that of lithium-ion batteries.

Sodium-ion Batteries

These are almost similar to the lithium-ion ones, but saltwater is utilized as an electrolyte and is extremely useful in terms of energy storage. Along with less dangers of catching fires, these batteries have the potential to store around two-thirds the amount of energy in spite of having a low energy density. Compared to the lithium-ion batteries, these work far better in lower temperatures and are trouble free to recycle because of the materials used during the production. As of now, they cannot be used in electric vehicles but researchers are inventing new processes and technologies that can make them suitable for EVs.

The Current Stage of Battery Production Capacity and Market Size

Of late, Counterpoint Research in its new survey report mentioned that by the end of 2025, passenger EVs will cross around 11 million units (including battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). It is largely expected that by 2025, the price of electric cars will be the same as that of a conventional ICE vehicle and at the same time, it will provide innovative opportunities for battery makers and OEMs. Therefore, it is speculated that the battery market of passenger EV(BEV/PHEV) will cross over 600 GWh by 2025 and will help the industry to grab US$60 billion profit.

Battery Energy Density And EV Range On The Rise

A month back, automobile giant Ford proclaimed that they will open a new factory in Michigan that will manufacture batteries out of lithium iron phosphate solely for electric cars. With an investment of $3.5 billion, the factory is expected to begin operation by 2026. In an interaction with the media, Bill Ford, Ford’s executive chair, said "This is a big deal,” said Michigan governor Gretchen Whitmer in a press conference unveiling plans for the factory. Expanding battery options will allow Ford to build more EVs faster, and ultimately make them more affordable."

Soumen Mandal, automobile researcher said, “CATL, Panasonic, LG Chem, Samsung SDI, and SK Innovation the leading battery makers are involved in a tussle to grab large orders from international car manufacturers. Therefore, they are also offering a stupendous stimulus to each other. For all the battery vendors, it is not very significant to align order backlogs as long-term orders are mostly flexible in price and quantity of sales and completely rely on the market situation. But, it is imperative to get a picture of buildup plans for the entire industry in an effort to track demand and supply movements moving forward.”

“The expansion of capacity has gained momentum because the international sales volume of EVs looks significant. Towards the end of 2018, the cumulative capacity reached 129GWh, while at the same time, the cumulative battery production capacity for electric cars will augment to 800GWh by the end of 2025, which will be spearheaded by the expansion of large OEMs,” added Mandal.

The batteries are mostly customized components when compared with other tech products. For instance, the EV batteries require optimization impeccably starting from the product development stage to get safety management and optimum power. The point to be noted is that the EV battery business is equipped with a large history of competitiveness in such product development along with mass production experience; the sector is involved with a huge entry challenge. Therefore, experts believe that the large OEMs will continue to spearhead the market and there will be no key alternations in the competitive scenario in the coming years for a while.

Justifying the statement above, Liz Lee, Associate Director at Counterpoint Research said, “What about the manufacturers who eagerly want to grab production and battery cell technology into their own hands? In the beginning, the large OMEs will be completely dependent on supply deals from various battery vendors. The long-term contracts will help to clear supply bottlenecks at a time of soaring demand and hold out the promise of cheaper batteries over time. In terms of emergency situations, the car-makers will have the ease in supply and can uplift cutthroat competition among all the vendors to get a better price.”