A day back, union Finance Minister Nirmala Sitharaman presented her fourth annual budget 2022-23 amid the outage of the new coronavirus variant Omicron. The budget aims to push for more investment in infrastructure and to boost financial activities and employment generation. The budget worth Rs 39.45 Lakh crore with an announcement to invest 4.6 percent more than the current year and further assistance of Rs 1 Lakh crore has been proclaimed for all the states. Back in 2021-22, total expenditure is estimated to be 8.2 percent higher than the budget estimate. The finance minister began her 90 minutes speech by reciting slokas of Mahabharata, which states, “The king must make arrangements for the welfare of populists by abandoning laxities and governing by Dharma.” She said, “I am proposing a new provision permitting taxpayers to file an updated return on payment of additional tax. This updated return can be filed within two years from the end of the relevant assessment.”

Announcing on tax benefits, Sitharaman added that a 30 percent tax will be levied on the earnings of any sort of digital or virtual assets coupled with no deductions other than the price of the merger or acquisitions. Moreover, a one percent tax deduction will be done on the payments made on the transfer of digital assets. Most importantly, there is no alteration on the income tax slab rates for corporations and individuals.

Ashis Kumar Basu, Senior Joint Commissioner of Revenue at Directorate of Commercial Taxes, West Bengal told exclusively to CircuitDigest, "With the announcement of this budget, Laws, and rules regarding the eligibility of Input Tax Credits are becoming more stringent. On the other hand, the last date of enjoying Input Tax Credits is being extended for about 40 days (up to 30th November of the following F.Y.). Then, Procedural changes have been effected in Section 37 to provide for further restrictions in case of furnishing of GSTR 1 returns. Such restrictions are to be introduced by way of rules. Also, amendment in GSTR 1 for an FY has been allowed to be made by 30th November of the next FY instead of September of the next FY."

Now, coming to the focus of the Make-in-India scheme and the growth of the electronics industry, the overarching ambition of Atmanirbhar Bharath is seen all over the allocations, feels Sandeep Aurora, Vice President – Business Development & Govt Affairs, IESA. The finance minister tried to keep the budget deficit down to 6.9 percent in a tough year. Apart from big outlays for core sectors, viewing technology as an enabler to improve ease of doing business, using it to make customs processing easier and transparent, enhanced digitization and digital currency, continued thrust to startups( which are beginning to flex its muscle in the last 2-3 years), duty concessions on a longer-term basis for electronics manufacturing, reaffirming the support for Semiconductors, setting a target to reduce oil import and create polycrystalline solar cells attractive, etc are strategies well tied together. Moreover, there is opening up defense R&D to start-ups, 65 percent of defence CAPEX is also available to local companies, new SEZ like rules to increase exports are all focused on Atmanirbhar Bharat.

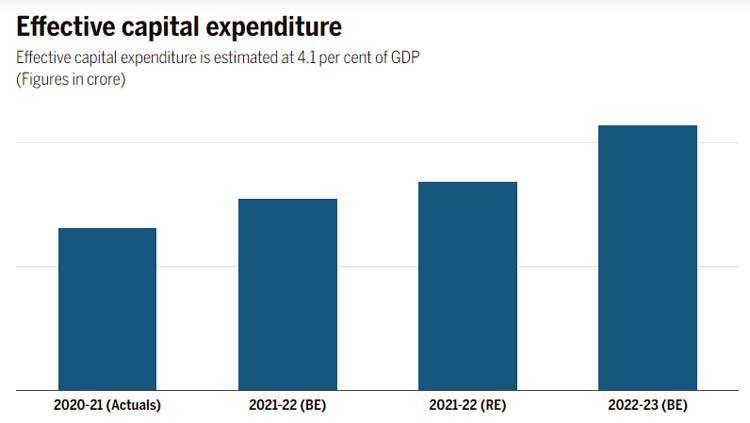

Source: Budget Documents (PIB)

Deepak Tiwari, a senior Chartered Accountant and a taxation expert, told exclusively to CircuitDigest, “Overall, the budget seems to be quite reasonable by keeping no unreasonable expectations and the primary objective of the Govt. seems to be keeping the fiscal deficit under check by keeping it under 7 percent and reducing the same in the coming years, and the recognition of Digital Assets has been long overdue. The electronic industry is expected to grow at a rapid pace in the upcoming years with the growing digitalization of the world and the govt’s intent to exploit the unexplored potential of India's electronics sector in order to generate employment opportunities and improve the GDP is quite evident with the budget announcements.”

“The duty concessions on parts of phone chargers, camera lenses of mobile cameras, and certain other items will provide high growth to the Indian electronic spare parts manufacturing industry. The rationalizing of custom duty on wearables and hearing devices is a welcome move to improve the competitiveness of the Indian manufacturers,” added Tiwari.

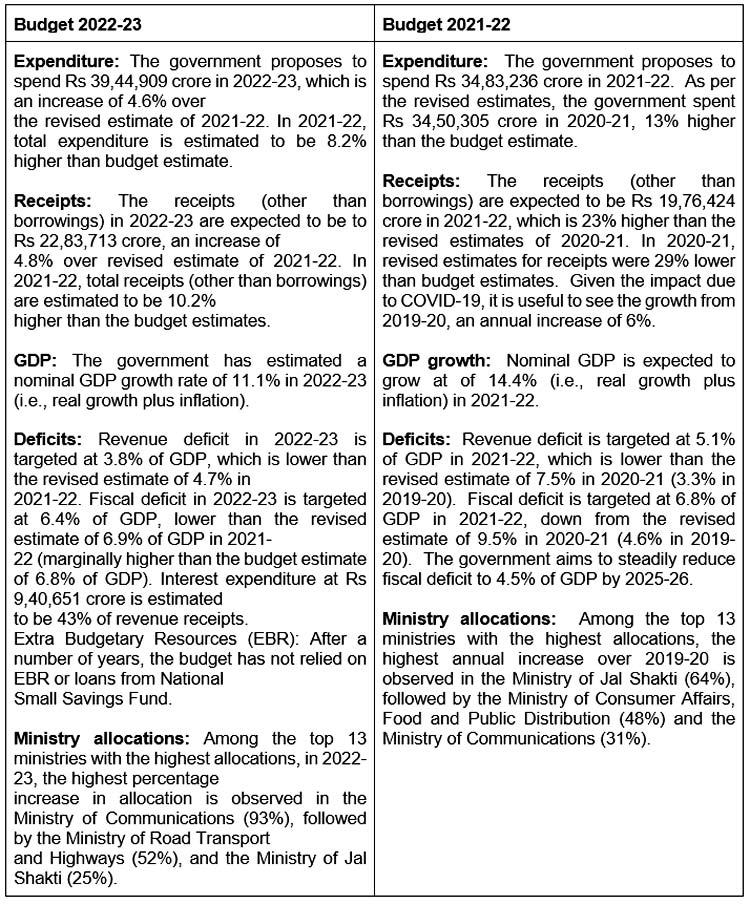

Before, analyzing further details let’s look at the basic differences between budget 2021-22 and 2022-23:

Electronics Industry

In order to boost the growth and demand of electronics-based hearable and wearable products, the finance minister during the ongoing budget session proclaimed a new-fangled phased manufacturing programme (PMP). She added that the duty charge on the components for manufacturing these devices will be zero completely from April 1 onwards. But, customs duty on imported items will be charged at 15-20% over FY 23-26. The Budget provides a thrust to the electronics sector and at the macro level, the focus on enhancing and creating new digital platforms will lead to growth in demand for electronics and ease of doing business. Further, the outlay for capital expenditure has been stepped up sharply with a 35.4% jump in CAPEX to 7.5 lac crores. This will bolster economic growth, infra projects, and employment opportunities. The projected capital expenditure is 4% of GDP.

Justifying the statement above, Rajoo Goel, secretary-general, ELCINA told the media “The announcement notifying PMP Schemes for Wearable and Hearable devices, a rapidly growing market segment in electronics as well as Smart Meters is a timely move and will put these high growth sectors on track for domestic value-added manufacturing. It is encouraging to see the government making early moves to encourage investment in these products. The PLI Scheme for Solar Photovoltaics is another relevant extension of the highly successful PLI Scheme/s of the Government of India. Electronics and power management equipment and components will see significant growth due to this Scheme.”

Interestingly, while the duty on import of major components will be levied at 0-15 percent from FY 23 onwards, the duty on imported neckbands, headphones, smartwatches, Bluetooth speakers, and earbands will be at a staggering rate of 20 percent. Pankaj Mohindroo, chairman of the Indian Cellular and Electronics Association (ICEA) opined that the announcement of PMP is a very gratifying move because the inverted duty structure has been rationalized, which was strangulating the enhancement of manufacturing in the sector.

A Gururaj, MD, Optiemus Electronics Ltd, said, "The industry has been completely galvanized under the pioneering initiative of PLI scheme that has potential to create 60 Lakh new jobs and additional production of 30 lakh crores. This is also a clarion call to the industry to work much harder in the years to come to make it a reality. On a macro level, the scheme around design-led manufacturing as part of the PLI scheme would fasten the development of the ecosystem, and also changes in customs duty will drive greater domestic value addition in Electronics manufacturing in the country, which has grown rapidly in the last few years.”

Electric Vehicle

One of the key announcements of budget 2022-23 was eco-friendly, spick and span public transport in India. In order to take it further, the finance minister announced the much-anticipated battery swapping policy for EVs, which is speculated to have a massive impact on electric car makers. According to experts, the upcoming policy will provide huge benefits to private firms who will go-ahead for new EV production and will work directly with the state government. Moreover, new mobility zones will also be developed, especially for electric cars. The battery swapping policy is to mitigate concerns over space crunch for expanding EV infrastructure. Make EVs more viable and lower range anxiety for buyers.

Soumen Mondal, senior research analyst, Counterpoint Research told exclusively to CircuitDigest, "As public transport plays an important role in urban mobility, the government is betting on battery swapping over charging stations in the initial years of EV adoption. The major constraints in the urban area are space and time, hence setting up battery swapping stations will resolve time-related problems. The battery swapping policy will provide an impetus for electric vehicle (EV) startups and private players to enter/expand on their current offerings and further increase the collaboration with state governments to make public transport cleaner and greener. Moreover, this policy once implemented will help in widespread adoption of batteries as a service and over time with economies of scale, we can expect the battery prices to go down and see increased adoption of EVs in the market."

The policy is extremely imperative because there is a rapid multiplication of degraded Chinese players that offer ‘cheap’ quality services that are raising the alarm of dependency and safety issues. There are several manufacturers of safe batteries and swap stations in India who will not have to opt for the inferior quality and safety standards if the policy manages to craft a structure to uplift the atmanirbhar and safety aspects.

The Budget at a Glance

- Specifically for the Electronics & Semiconductor industry, in addition to the recent mega announcement of the India Semiconductor policy, the emphasis is on the following:

- Ease of Doing Business and Agile Policy making – with a trust-based approach which is a key enabler for the Fast evolving ESDM industry.

- Kick-off of PMP for key strategic products like Hearables, Wearables & Smart meters is a continuation of India’s ESDM Atma Nirbhar strategy.

- The focus of the Government on support for R&D by bringing in public funding for R&D over and above the current academic and academia-industry framework is very encouraging.

- Along with the allocation of 5% of the USO Fund for R&D in products to take broadband into rural India. This can play a huge role in bridging the digital divide.

- Agile Policy steps of extension of the start date for manufacturing for “Concessional tax regime”, the incorporation date for Start-ups for availing Tax incentives are great steps and it demonstrates GoI walking the talk on Agile Policy Initiatives.

- The PLI scheme has been a key enabler for India's growth in a variety of segments. This continued push to enable the ESDM industry with a world-leading incentive framework in both manufacturing and R&D will make sure that India becomes a power to reckon with in the Semiconductor and electronics space. This will also help enable new high-skilled jobs for which capacity enhancements will need to be done.

- The SME’s are big suppliers to Public procurement across verticals. The move towards End to End Digitization of procurement processes with time-bound payments will be a big support to SMEs.

Let’s find out what the industry experts opine about the impact of the union budget 2022-23:

Ashis Kumar Basu, Senior Joint Commissioner of Revenue at Directorate of Commercial Taxes, West Bengal

"The month of January has earned a record of GST, Rs.1.41 lakh crore. The government is eager to get this indirect tax in a disciplined manner. In short, this year the budget has made some stringent provisions against fake business persons or those trying to get associated".

Sohinder Gill, Director General, Society of Manufacturers of Electric Vehicles (SMEV)

"The budget for 2022–23 gives a huge impetus to the electric vehicle (EV) industry. Introducing the battery swapping policy and recognizing battery or energy as a service will help to develop EV infrastructure and increase the use of EVs in public transportation. It would motivate businesses engaged in delivery and car aggregation businesses to incorporate EVs into their fleet. It will create new avenues for companies to venture into the business of battery swapping. Additionally, creating special clean zones will further accelerate the adoption of EVs and spread awareness amongst the citizens. The move will benefit the whole segment, i.e E2W, E3W, E-cars, and buses".

Karnika Seth, Senior Lawyer, Supreme Court of India

"Budget 2022 aims to promote the growth of manufacturing in the electronics sector. While electronic items Wearable tech, cameras, chargers will become cheaper, custom duty on such electronic items will increase. It is a strategic standpoint to give a fillip to and promote the Make In India initiative which is not only a positive but promising move!"

Ajay Aggarwal, Executive Director & CFO, Cyient

"While most organizations are working towards reducing carbon footprint and sustainable ways of development, it was critical to have the government's support to create regulation frameworks and invest more in renewable resources. The additional Budgetary allocation of INR.19,500 crores for Production linked incentives for manufacturers of high-efficiency solar modules to meet the solar power demand as well as the 5 to 7 percent biomass pellets to be co-fired in thermal power plants to have the CO2 savings are the measures worth mentioning in the current Budget".

Rajoo Goel- Secretary General, ELCINA

"At the outset, it is noteworthy that the Annual Union Budget is no longer limited to ‘annual’ policy document tweaking tax rates and procedures or limited to announcing budget allocations for key sectors. Instead, it has become a long-term policy document outlining the roadmap of the government. The Budget now provides impetus to the long term vision and goals which would determine the future of our country, economic as well as social, complemented by the required physical and digital ecosystem".