The pandemic has played a spoilsport, and the challenge has quickly shifted to extracting the ROI out of their investments in the current economic scenarios.

Over the past couple of years, 5G started rolling out across the globe, which started representing a landmark move in the history of ICT. The timeline has offered us rich and detailed insights into the hunger for 5G and possible use cases. But, we must understand exactly what is the current scenario of 5G in the pre and post-pandemic and the various impediments it witnessed in its path.

A lot of service providers have successfully deployed 5G networks globally and started providing its benefits to the users, but suddenly the entire sector had to deal with the unanticipated consternation and financial ambiguity sparked by the COVID-19 virus that has postponed coverage expansions, deployments, and rollouts in certain markets.

As of July 2020, there were 92 commercial networks in 38 countries and 150 million 5G subscribers in China. Apart from that it has been forecasted that around 320 million 5G subscribers will be in the US by the end of 2025, and 8 million 5G subscribers in South Korea, as per a survey conducted by Ericsson Mobility.

How COVID-19 Pandemic Impacting Global Rollout of 5G Deployment

Since the pandemic commenced creating mayhem across the world, time spending on display has escalated among consumers. As per the survey by Ericsson, over 50 percent of people stated that they are spending their time on streaming devices, and around 45 percent of people are spending time on social media and messages.

As per international research firm IDC, although most Asia Pac countries started their 5G journey (NSA for the most) in 2019/2020 with relative ease, the pandemic has played a spoilsport and it has become difficult to extract the ROI. So IDC believes that the transition to SA will take some more time in the developing AP economies like Korea, Australia, and HK will lead in SA deployments. This is when the data growth is further expected to grow leaps and bounds with new 5G-ready devices hitting the markets, so initial use cases seem to be targeted to eMBB and massive IoT.

In an exclusive interaction with CircuitDigest, Yash Jethani - Research Manager - Telecom & IoT – IDC, said “Of all the AP economies, India seems to stand as an exception – the spectrum is allocated in much of ASEAN, ANZ and North Asia (India the notable exception right now) and services are available in China, South Korea, Australia with more coming every day. India has not totally aligned itself with 3GPP so the device ecosystem, PLI schemes, and other benefits for export-oriented growth will not be fully in sync, and India’s growth could be curtailed in IDC’s view. So the other challenge is around standardization.”

On the possible solutions and way forward, satellite connectivity should be thought of as augmenting terrestrial B2C connectivity along with carrier aggregation, the active sharing of spectrum, and infrastructure decoupling, so operators and governments should be progressive on the regulations related to ‘inclusion for all’ and ‘connectivity for all'. This should be complemented with B2B use cases in 5G for enhancing supply chain inefficiencies across the RCEP group, ASEAN, and India; and the right investments in private 5G cellular (with numerous business models with 3rd party infra, tower companies, etc.) for business entities requiring higher security demands and/or tailor-made solutions.

“Lastly, close and continuous coordination of country regulators, ITU-APT, and other inter-government bodies tackling climate change, supply chain, and last-mile logistics with de-risking and diversification, aiding nimble infrastructure deployment methods and tackling data security and sovereignty issues. So prioritization, commitment, and execution will be the key points to understand as to how 5G will solve tomorrow’s global problems,” opined Jethani.

Current Scenario of 5G and how it could be a game-changer

In the middle of 2020, we heard much buzz about the delay of 5G, and the release of 17 implementations that will be the inflection point of 5G. Satyajit Sinha - Senior Analyst - IoT Analytics, told exclusively to Circuit Digest, “However, we can see a smooth transition of the high-end 4G module to the 5G module. There is much activity not only from chipset players but also from Module players. By the end of May 2021, 443 operators in 133 countries/territories were investing in 5G.”

- 159 of those operators in 66 countries/territories had launched 3GPP-compliant 5G mobile services

- 62 operators in 35 countries/territories had launched 3GPP-compliant 5G FWA or home broadband services

From India's perspective, 5G devices are already deployed much before the 5G network. It is expected to launch by 2H 2022. However, we can see much development:

- Jio partnered with NXP to implement a 5G NR O-RAN small cell solution in India

- Bharti Airtel partnered with Tata Group to implement 5G networks solutions for India

“5G is much more than about speed. It will open the door for a plethora of IoT and AI applications. Further, 5G will play an increasingly important role in high-bandwidth and low-latency applications such as autonomous cars, drones, high-definition intelligent surveillance cameras, and industrial IoT,” added Sinha.

Where does the growth of 5G deployment stands currently?

Ookla, the internet performance tester in its report on December 2020, stated that overall 5G deployments escalated by 62.3 percent between Q3 2019 and Q3 2020 with 99 countries having the rollout. It also revealed that there were 14,643 cities globally with 5G deployments at the end of Q3 2020, a 1,671 percent increase over Q3 2019. The total number of deployments internationally was 17,046.

According to various telecom experts, by the end of Q3 2020, the majority of cities that received 5G deployments were in the US around 7,583, which is then followed by Germany, Austria, Netherland, and Switzerland. Netherland witnessed the biggest percentage change in the number of 5G deployments between Q3 2019 and Q3 2020 with a 50,350 percent jump from two deployments in Q3 2019 to 1,071 in Q3 2020.

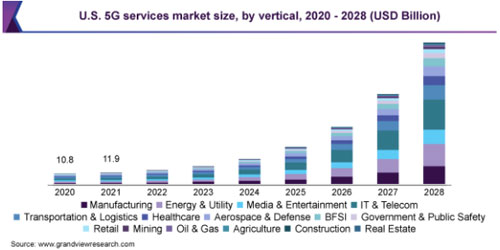

Research firm Grand View Research has something else to say. According to them, the international 5G services market size was valued at USD 41.48 billion in 2020 and is speculated to augment at a compound annual growth rate (CAGR) of 46.2 percent from 2021 to 2028.

Initially, in the US, deployment of 5G has utilized millimeter-wave frequency bands in the 28GHz and 39GHz bands that proved to offer remarkable speed. Then, after that, rapid deployment in the 600MHz band has included a considerable countrywide 5G footprint.