The top-notch technology will provide a huge impetus to the R&D initiatives, but the major impediment is the lack of wafer fabrication at this level.

A recent survey report by Counterpoint Research highlighted that in 2022 the growth in revenue of international semiconductor wafer fabs augmented to 9 percent year-on-year, worth $120 billion. Experts added that this is staggering growth because for the past couple of years, there has been a massive imbalance in the logistics sector, massive shortages of components, currency undulation, and most importantly, macroeconomic slump. But, the situation proved to be very optimistic for the wafer fabs owing to the huge investments by the customers in the mature node devices across numerous segments such as 5G, AI, automotive, HPC, and IoT. Suppliers, which are at the top five, witnessed a huge profit of $95 billion in their services and systems.

While speaking of the revenue of the wafer fab equipment’s market, it is anticipated to reduce by 10 percent year-on-year to $108.45 billion after a continuous growth in the past three years. Although the market for WFE in 2023 does not look promising, the prospect of Extreme ultraviolet lithography (EUV) lithography looks quite promising due to continued deployment of EUV into logic and memory. Not only that, foundries all over the world are increasing manufacturing chips of 3-nm nodes by utilizing FinFET architectures and Gate-All-Around transistors along with escalated adoption of EUV technology.

Dale Gai who is the associate director at Counterpoint Research opined that over the last couple of months, TSMC has started working on innovative capacities in in 7/6nm and 5/4nm owing to the decreased demand in the market, but the capital and the investment on 3-nm process nodes remains almost same like it was planned in the first half 2023. The point to be noted is that during the time of COVID-19 pandemic, various segments of the semiconductor industry have witnessed soaring prices because of the huge disruption in the supply chain. On the other hand, the electric vehicle technology is gaining a huge momentum and therefore, the entire automobile industry has seen a surging growth.

Nonetheless, the unexpected increasing demand of semiconductors during the time of pandemic has caused prices to augment in the data center and industrial market. The slow growth has also happened due to the inflation, which has reduced the orders for consumer electronic goods, and mobile phones. The expansion of AI, start-ups, and other technologies are happening on a rapid scale, the requirement of microchips are also increasing throughout the world.

![]()

Recession is another major obstacle currently among various industries, which has forced semiconductor companies to take into consideration whether they should increase the output of wafer fabs or not. The current skills in manufacturing and end-to-end design are magnetizing the interests of various businesses across the globe. The top-notch technology will give a huge impetus to the R&D initiatives, but the major impediment is the lack of wafer fabrication at this level. Building a wafer fab requires huge investment and is very expensive and also needs gallons of water which is why there are not many fabs available currently. Here, government incentives and subsidies will play an imperative role and the Chinese government has already assured to invest around USD 73 billion as semiconductor subsidies, while Japan, US, and Europe failed to equate that amount.

In the past three quarters, no major investment unifications have been done and therefore every country is investing on their own without proper analysis and knowledge. As consumers now require more top-notch devices, the production must be increased to a larger extent, feel experts. There are about 150 300-mm fabs located, with 12 in Europe and Middle East, 33 in China, 42 in Taiwan, and 19 in the US. This is why the volume of supply as per the demand is still unnatural. The massive level of production and activity still happens at the 200-mm fab with demand being the same for various nodes starting from 90nm to 180nm processes. The total number of 200mm fabs all over the world is 230 with 49 in the Middle East and Europe and 51 in the US.

The question here appears to be why the WFE market increases every year. As per a previous report of CircuitDigest, various characteristics such as the escalating demand from the consumer and B2B electronics industry coupled with ever-increasing technological improvements in the semiconductor and telecom industry are speculated to spearhead the demand for the semiconductor wafer fab equipment market from 2019-2030. There are some additional factors like equipment and silicon wafer that would assist in analyzing the concerned market in the coming years. Most importantly, new-fangled innovation in wafer technology has crafted a denser packaging of devices like transistors and MEMS (micro-electro-mechanical system) are speculated to create a way for the foundation of innovative opportunities that can be leveraged by various global firms.

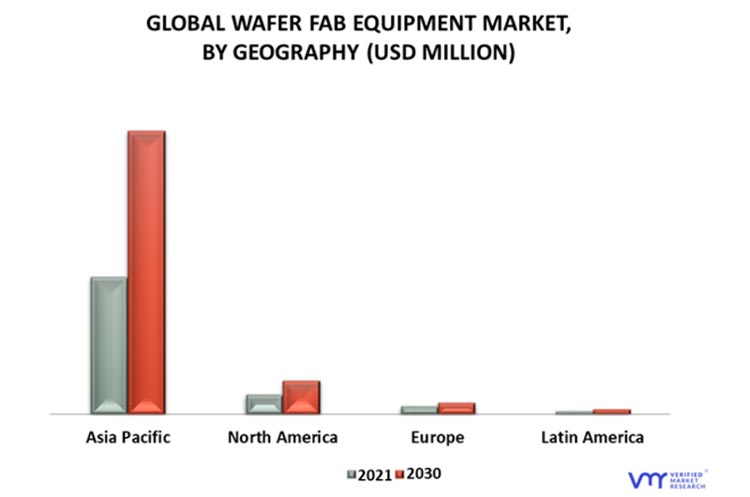

Now, speaking of the current wafer fab market globally, in 2021 the market was worth USD 62930 million and by 2030, the market is expected to reach at USD 97470 million at a CAGR of 5.6 percent between 2022-30, according to a report of capital market firm MarketWatch. But, another research firm Verified Market Research added that in 2021, the WFE market reached at USD 68,989.03 million and by 2030, it is expected to grow USD 164,669.67 Million at a CAGR of 8.04 percent between 2023-30. The technological developments over the past few years have spearheaded the growth of this sector. The growth in memory storage capacities and the augmenting compactness of numerous communication products in the telecom industry are responsible behind this growth.

Going by the detailed analysis, the WFE market is divided into Latin America, Europe, North America, and Asia Pacific. In 2021, the biggest market share in this segment was grabbed by the Asia Pacific region and is expected to increase at a CAGR of 8.53 percent in the forecasted period. The region is leading because of the fact that there are solid supply chains of semiconductor devices such as discrete devices, circuits, and logic circuits across nations like China, Taiwan, and Japan. As there is a huge growth in consumer electronics and automotive products, the demand for IC chips and SIC wafers are also expected to increase.

Other than that, there are huge volumes of suppliers in South Korea and in India, who are contributing to the huge growth of this market. In the same year, North America stood as the second biggest region and during that time it was predicted that this region is likely to contribute massive growth. But huge subsidies, and incentives offered by the government of the Asia Pacific region has helped them to lead the market. Increasing demand along with rising income, growth of advanced machinery and technology, and programs for spreading the importance of the requirement will help the WFE market to grow immensely over the years.

Counterpoint’s Senior Research Analyst Ashwath Rao said, “Considering the growth in terms of US dollar, the overall volume of WFE market slumped by around 8 percent in 2022 as it was negatively impacted by currency fluctuations, and especially reduction in value of euro and yen denominated sales ever since the starting of 2022. Ahead of the inflection in 2022, there is an escalation in R&D investment that has put the WFE market to outperform the semiconductor market for a long term.”

Highlighting the overall scenario of the market in 2023, Rao mentioned in a survey report, “Manufacturers are more skewed towards foundry-logic segments today unlike in 2019, and with overall backlog strength, increased visibility in terms of long-term agreements and subscription model will help limit the downside. The weakness in wafer fab equipment spending in 2023 will drive lead time and inventory normalization. The slowdown in memory-oriented investments will begin to recover gradually starting in the second half of 2023, and 2024 will be a big year for the equipment industry. Manufacturers are well positioned to take advantage of the opportunity."