- To mitigate this threat, India must rapidly transition from import-dependence assembly to value-added component manufacturing.

- Value-added manufacturing requires a huge thrust on manufacturing components, parts, and their raw materials, which have a vast variety and are technology intensive.

India’s electronics industry is catalyzing economic transformation with an ambitious manufacturing plan to cater to both domestic and global markets. Electronics production is projected to grow from USD 107 billion to USD 300 billion by 2026, and further to USD 500 billion by 2030, reflecting strong confidence from manufacturers and investors.

Recent years have witnessed a significant increase in product assembly activities,especially in the mobile, consumer, IT, industrial, and telecom sectors, for which domestic and global companies have expanded production capacities in the country. However, the growth has been heavily reliant on imported components and sub-assemblies, with 60 percent plus of these imports appearing from China. This dependence threatens the sustainability and competitiveness of India’s electronics manufacturing ecosystem, which is of strategic importance.

To mitigate this threat, India must rapidly transition from import-dependence assembly to value-added component manufacturing. Achieving this transition requires an enabling environment to build large-scale capacities in high-potential components and sub-assemblies. Integration with the global value chain is also essential to fulfill the government’s vision of “Local Goes Global” and Atmanirbhar Bharat. In an effort to grow the industry and making it globally competitive industry bodies such as ELCINA has been advocating for a targeted policy to encourage growth of value-added manufacturing of components and critical assemblies to establish India as a global supply base, fostering a competitive and sustainable electronics manufacturing ecosystem with a global footprint.

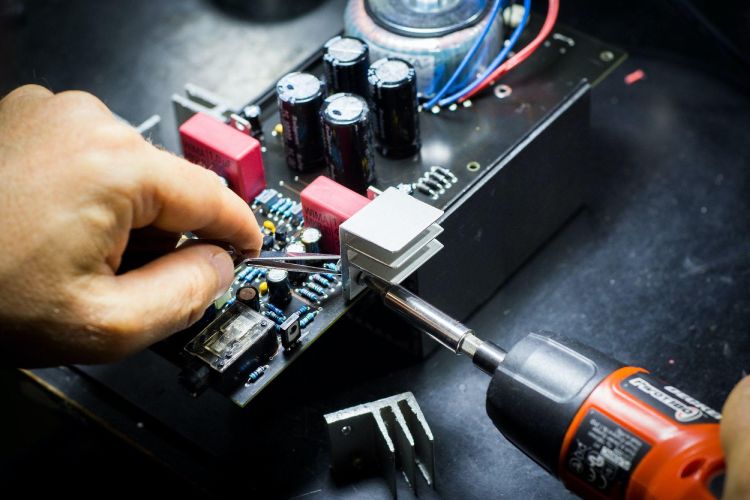

S Krishnan, IAS, Secretary MeitY said, "Ten to fifteen years back, the department was not looking to develop the core electronics and the focus was mostly centered upon developing software, e-governance and other aspects. Currently, 70 percent of PCBs used in India are still imported. But, in the past 5-6 years, the core electronics mojo is back again on the right track. India is now having a very successful PLI on IT hardware and 27 companies have signed MoUs. Many of them have already started operating. This PLI offers benefits even to the existing companies and provides subsidies as well. The overall projected investment is only about Rs 2,500 Crores."

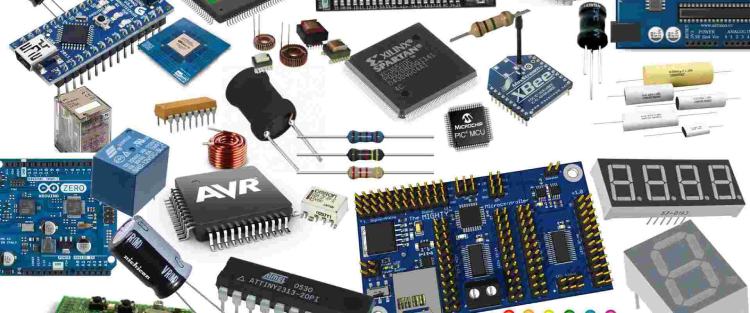

What Value-added Manufacturing Requires?

Schemes to promote the ESDM sector announced under NPE 2019 policy have given encouraging results and set the ball rolling. It has strengthened the ecosystem including R&D and infrastructure and by incentivizing capital investment, production has multiplied fivefold to US$ 140 billion in the last ten years. The catch however is that success has been notable in the assembly of finished equipment and EMS. These policies have had limited impact on value-addition and/or deepening of the value chain and without the same a sustainable and globally competitive industry cannot be established in India.

Other than this, value-added manufacturing requires a huge thrust on manufacturing components, parts, and their raw materials, which have a vast variety and are technology intensive. This segment of the supply chain requires high investment and is characterized by low investment to turnover ratio, long gestation period as well as high intensity of energy, finance, and labor requirements.

A couple of days after Narendra Modi was elected as Prime Minister for the third consecutive time, reports in the media surfaced that the union cabinet is all set to unleash Rs 30,000 Crore electronics component scheme. The scheme, which is a part of the government’s coming 100-day agenda, will provide ample subsidies for acquiring land to set-up industries for manufacturing critical components. An exclusive report by Money control stated that the scheme is expected to be rolled out in August-September and the majority of the funds will be allocated towards capital subsidies for purchasing land to manufacture certain electronic components, which has a lower capital output ratio. The upcoming scheme will appear in place of Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS), which has already expired on March 31. A senior government official who wishes to be unnamed told the media, "We are not doing it as a PLI scheme… It may or may not be a PLI. It could be a mix and match of a variety of things because there will be certain cases where we have to do a capital subsidy."

Speaking of the growth of the sector, Amrit Manwani, Chairman at Sahasra Group of Electronics said, “India has immense potential to lead the global value chain in this industry. But in order to meet the same, the government must look to focus deeply on building components manufacturing and the associated supply chain. The infrastructure needs to be top-notch and there should be separate schemes to boost non-semiconductor components.”

What the New Government Must Do to Grow the Component Manufacturing Ecosystem

The India Semiconductor Mission (ISM) has been established to provide high priority for development of semiconductor wafer fabs, compound semiconductors, ATMP, and design which have similar characteristics. A focused scheme on non-semiconductor components, electronic modules (display, sensors, audio, batteries) and some discrete active components which are not covered under ISM is the need of the hour. For instance, ELCINA has submitted its recommendations for a scheme which will propel this critical segment of the electronics and target high double-digit growth.

As one size does not fit all types of components, they are judiciously divided into six categories. Of these, the sixth category is the ‘Other Components’ which is further subdivided in five categories. This has been done to make the recommendations effective and targeted to address the specific needs of each segment.

1. PCB

2. Electromechanical

3. Semiconductor/Active

4. Passive

5. Magnets & Wound

6. Other Components

a. Speakers, microphones, senors, and motors

b. Mechanics

c. Display Assembly/Module

d. Battery (Overall)

e. Camera Module

The above segments have been done on the following criteria which determine the strategy required to address the hurdles faced by each of these segments. There are:

- Investment to Output Ratio

- Value Addition

- Financial Investment to Achieve Competitive Scale and Critical Mass

- Labor Intensity

- Technology Requirement and Availability

- Import Dependence for Inputs

Important Recommendations to The Government to Boost ESDM Sector

The growth target in this industry is an idealistic goal to achieve India’s vision to become a global player in the ESDM sector. It is critical because of the growing importance of electronics technology in all spheres. For a country of our size, continued dependence on imports is a huge strategic risk exposing us to cyber, defense, and internal security related attacks. Strengthening the components ecosystem and strengthening our capabilities in design will enable India to be part of the global value chain and resilience for sustainable growth.

For instance, ELCINA has done a detailed analysis and multiple stakeholder consultation on the above criteria and taken inputs from industry experts as well as estimated item wise data for production, imports, exports, and demand. ELCINA has projected the production and demand supply gap on the basis of Business as Usual (BAU) without incentives and accelerated production with the proposed incentives. The incentives are proposed in two categories, High Priority Components and Standard Priority Components. It is noteworthy that with incentives the demand supply gap is reduced by US$ 23 billion by 2026 and 145 billion by the end of 2030.

Rajoo Goel, Secretary General of ELCINA said, “This is the time for India to realize its potential and become a major player in the global value chain for the electronics industry. The ISM’s package of Rs 76,000 Crore has generated significant interest in the country, though it may not be sufficient to fuel the industry for long, and the government must think to enhance the allocation for semiconductor manufacturing. We must further improve ease of doing business in India thus ensuring predictability for investors to pursue their projects with confidence for success.”

With right policy interventions and adequate quantum of incentives an additional capacity of US$ 23 billion and US$ 145 billion can be created by 2026 and 2030 respectively. The success story of mobile manufacturing in the country with exports crossing USD 10 billion and 100 million in numbers set a benchmark. It also boosted the confidence in the Indian ecosystem and the delivery mechanism of government backed projects. The nation has shown great initiative in developing the product and manufacturing ecosystem in the country and the government has provided due support to enable this growth.