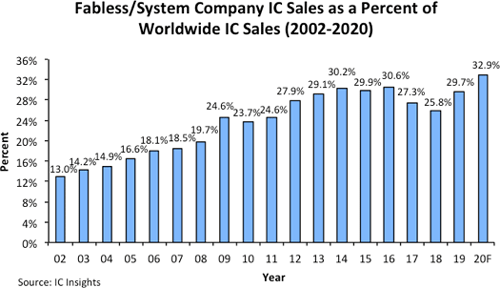

According to the IC Insights report - A Complete Analysis and Forecast of the Integrated Circuit Industry, Fabless Company's share of worldwide IC sales will set a new all-time record at 32.9%. There is a 22% jump expected in the company sales this year, led by a forecasted $2.8 billion sales increase by AMD as compared to only a 6% IC sales increase forecast for the IDMs.

IC Insights will be releasing its new 2020 McClean Report – “A Complete Analysis and Forecast of the Integrated Circuit Industry” in the first month of 2021. A portion of the new report will examine the top-50 semiconductor sales leaders, the top-50 fabless IC companies, and the major semiconductor foundries in 2020.

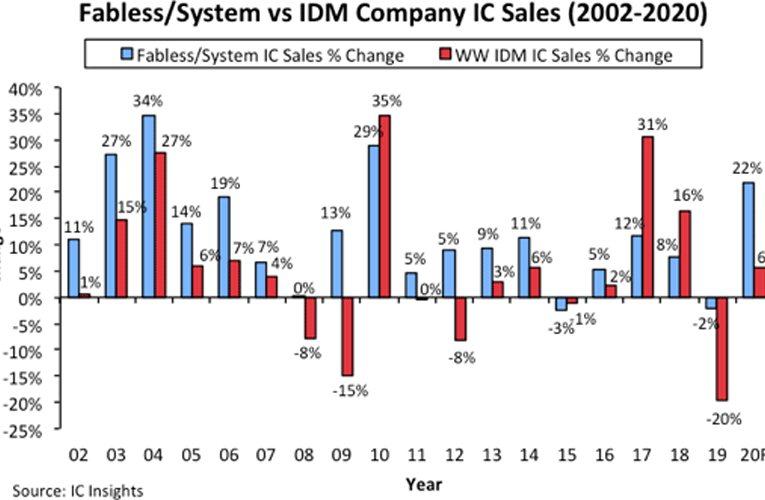

The report predicts that company sales will be more than double from 2010 to 2020 ($63.5 billion to $130.0 billion) and the total IDM IC sales are expected to be up only 30% over this same time period i.e. from $204.3 billion in 2010 to $265.7 billion in 2020. IC Insights pointed out that the sales growth of fabless IC companies versus IDM (integrated device manufacturers) IC suppliers have typically been very different. In contrast, it continued, there is a relatively close relationship between the annual market growth of the fabless IC suppliers and foundries. There is a typical disparity in the annual growth rates in favor of the fabless/system IC suppliers versus the IDMs and except in 2010, 2015, 2017, and 2018 fabless/system IC companies have increased their share of the total IC market.

In 2002, the Fabless/system IC company sales accounted for only 13% of the total IC market. Fabless companies have very little share in the memory market that soared in 2017 and 2018 but the company’s share of the total IC market lowered in these years. However, the memory market has registered growth and the situation reversed itself, with the fabless share of the total IC market increasing 3.9 percentage points in 2019 to 29.7%.

IC Insights believes that over the long-term, Fabless/system IC suppliers and IC foundries that serve them will continue to be a strong force in the total IC industry landscape, with their percentage share of the total IC market expected to remain in the low 30s over the next five years.